Most people don't think about inflation and recession in the same sentence, but these two economic terms are closely related.

Inflation measures how much prices have increased relative to a stable standard, while a recession is an economic slowdown that generally occurs when consumer spending decreases due to household uncertainty and tight credit conditions.

So can higher levels of inflation cause a recession? Let's dive into this topic and explore why they could be connected!

What is Inflation

Inflation is the generalized increase in prices of goods and services over time that reduces the purchasing power of a currency. It is the depreciation of financial assets. Inflation is measured as the percentage change in an average price level over a certain period for a given basket of goods and services.

How Does Inflation Affect Consumers

Inflation can affect consumers, impacting their purchasing power, savings, and overall financial well-being.

Here are some ways in which inflation affects consumers:

Decreased Purchasing Power

Over time, inflation reduces the purchasing power of money. As the average price of products and services increases, consumers must spend more to purchase the same amount. As a result, customers can spend the same amount of money on fewer goods and services, which lowers the value of money.

Increased Cost of Living

Inflation can increase living costs as the prices of essential goods and services, such as food, housing, healthcare, and transportation, rise. This can strain consumers' budgets and make it more challenging to maintain their desired standard of living.

Impact on Savings

Savings might lose value over time due to inflation. The real worth of savings declines as inflation outpaces return on investment. Savings lose 1% of their purchasing value annually if inflation is 3% and interest rates are 2%.

Uncertainty and Financial Planning

High or unpredictable inflation can create uncertainty in the economy, making it challenging for consumers to plan their finances effectively. It becomes difficult to estimate future expenses, save for long-term goals, or make accurate projections for retirement planning.

Impact on Borrowing and Debt

Borrowing and debt may be affected differently by inflation. Money loses value over time when there is severe inflation, which could lead to a decline in the real value of debt. As they repay loans with money that has less purchasing power, borrowers may benefit from this.

However, if inflation leads to higher interest rates, borrowing costs can increase, making it more expensive for consumers to borrow money.

Wage and Income Adjustments

Inflation can influence wage and income adjustments. In an inflationary environment, employers may raise wages to keep up with the rising cost of living.

However, there may be a lag between inflation and wage adjustments, which means that consumers' incomes may not immediately match the pace of price increases, leading to a temporary decline in real wages.

Consumer Behavior Changes

Inflation can influence consumer behavior. Consumers may prioritize spending on essential goods and cut back on discretionary purchases. They may also seek ways to stretch their budgets, such as searching for discounts, comparing prices, or opting for lower-cost alternatives.

It's important to note that the impact of inflation can vary depending on individual circumstances, income levels, and spending habits. Additionally, moderate inflation can positively affect the economy by encouraging spending and investment.

However, high or volatile inflation can create challenges for consumers, affecting their purchasing power, savings, and financial planning. Individuals should consider inflation when budgeting, saving, and making financial decisions to mitigate its impact on their finances.

How Are Inflation and Recessions Connected

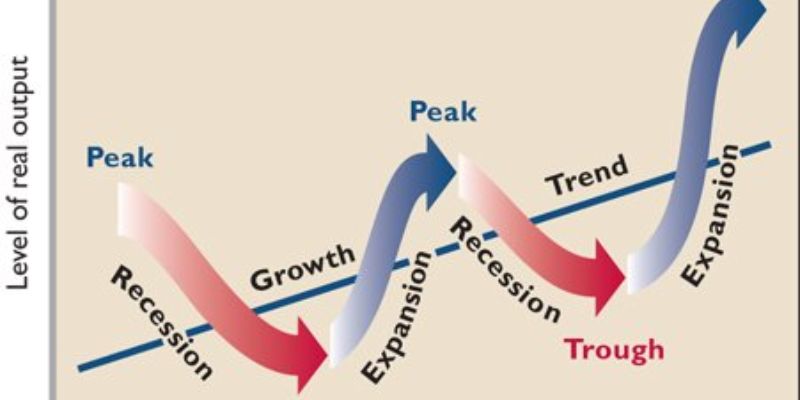

Inflation and recessions are interconnected economic phenomena that can influence each other.

Here's how inflation and recessions are connected:

Demand-Pull Inflation and Recessions

Demand-pull inflation occurs when the aggregate demand for goods and services exceeds the available supply, increasing prices. In an overheated economy with high levels of consumer spending, businesses may struggle to keep up with demand, causing prices to rise.

However, if the economy enters a recession characterized by reduced consumer spending and decreased aggregate demand, it can help alleviate demand-pull inflationary pressures.

With lower demand, businesses may lower prices to stimulate sales, potentially leading to decreased inflation.

Cost-Push Inflation and Recessions

Cost-push inflation happens when rising production costs for businesses increase the cost of goods and services. Rising salaries, rising raw material costs, or higher taxes can exacerbate cost-push inflation.

During a recession, when economic activity slows down and businesses face reduced demand, the pressure on production costs may decrease. With lower demand for labor and inputs, businesses may experience a decline in cost pressures, potentially leading to a moderation in inflation.

Recessionary Effects on Inflation

Recessions often result in decreased economic activity, rising unemployment, and reduced consumer and business spending. As demand weakens, businesses may need to help maintain profit margins and be less able to pass on cost increases to consumers.

This can lead to a decrease in inflationary pressures during a recessionary period. Additionally, recessions may lead to reduced borrowing and investment, which can further contribute to a decline in demand and inflation.

Central Bank Response

Central banks often employ monetary policy measures to stimulate economic activity in response to recessions. This can include lowering interest rates, implementing quantitative easing, or other measures to increase liquidity and encourage borrowing and spending.

These expansionary monetary policies can potentially increase the money supply and, in turn, contribute to inflationary pressures. Central banks must carefully balance their response to recessions to support economic recovery while keeping inflation in check.

Expectations and Feedback Loop

Expectations play a crucial role in the relationship between inflation and recessions. If consumers and businesses expect high inflation, they may adjust their behavior accordingly, such as demanding higher wages or raising prices, potentially fueling inflationary pressures.

On the other hand, if expectations of future inflation are low, it can help stabilize prices and mitigate inflationary pressures during a recession.

It's important to note that the relationship between inflation and recessions is complex and can be influenced by various factors, including the severity and duration of the recession, the underlying causes of inflation, and the monetary and fiscal policy responses.

Inflation and recessions can significantly affect economic stability, consumer purchasing power, and the business environment.

FAQs

What triggers recession?

Economic downturns typically trigger recessions, which can result from various causes. These include excessive consumer debt, speculation in financial markets, an increase in the cost of borrowing money, or a decline in aggregate demand for goods and services.

How long do recessions last?

Recessions typically last anywhere from 6 months to 2 years, although the exact duration depends on various factors. Factors such as the recession's severity and government intervention can determine how long an economy can recover.

What is the most effective way to combat recessions?

The most effective way to combat recessions is through fiscal policy initiatives such as tax cuts or increased government spending. Monetary policy measures, such as lowering interest rates or increasing the money supply, can also help stimulate economic activity and mitigate recessionary effects.

Conclusion

We can't ignore that they often coexist regarding inflation and recession. Indeed, most economists agree that high inflation levels can eventually lead to a recession if not managed effectively.

So the question remains: Does Inflation Cause a Recession? As you can see from our exploration of this topic, the answer is yes – but only when controlling inflation proves too strenuous to manage other aspects of an economy!

Checking Accounts: Definition, Types, And Everything You Need To Know

Why Home Sales Hit Roadblocks: Unraveling 5 Key Challenges

Deciphering Insurance Underwriters: Unveiling Their Roles and Responsibilities

Does Inflation Cause a Recession

Understanding the Harmonized Sales Tax: A Comprehensive Guide

The European Central Bank (ECB): An Overview of its History, Objectives, and Activities

The A-Z of Defined Benefit Plans

Choose the Best Health Insurance for Your Small Business

What Does ARV Mean in Real Estate

Unlocking Savings: A Step-by-Step Guide to Balance Transfers with Your PNC Credit Card

7 Effective Strategies for Teaching Your Kids Financial Literacy